The second day of the quarter, April 1, 2014, marked the first official day of the newly appointed UC Chief Investment Officer (CIO) Jagdeep Singh Bachher. As UC CIO, his job entails the responsibilities of investing the UC’s $80 billion in assets, including the UC’s pension, endowment, short-term and total return investment pool.

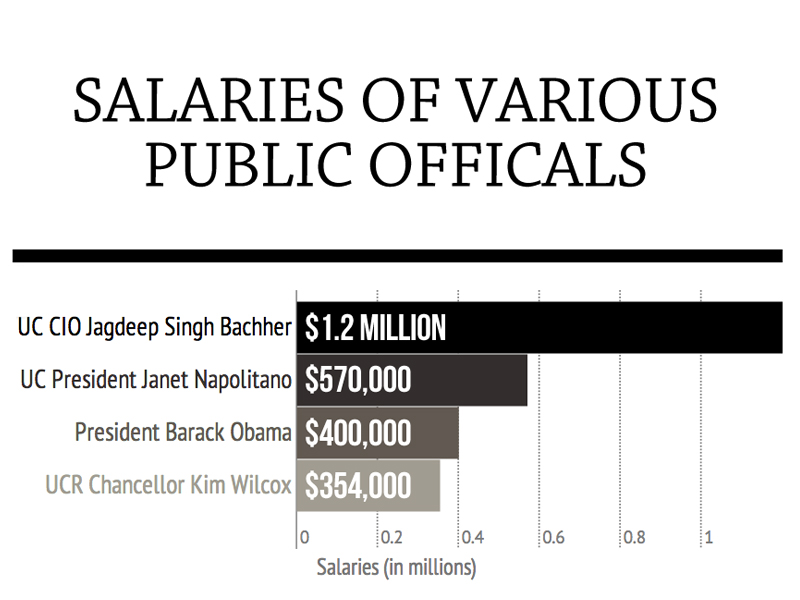

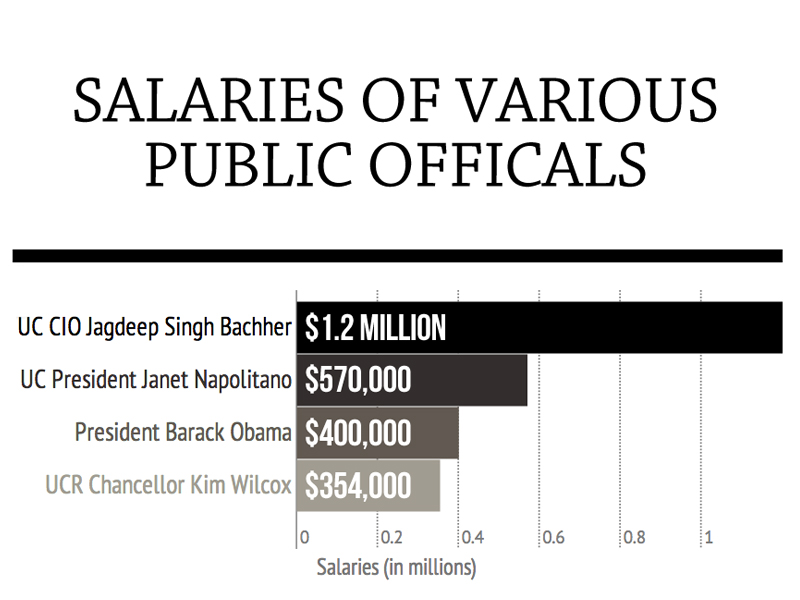

The compensation of being CIO for the UC system is $615,000 annually, but earnings could potentially surpass over a million dollars if it is determined he is exceeding expectations in financial returns. Bachher’s salary is to be funded entirely from non-state sources, and the funding comes mainly from investment returns, not tuition or tax revenues. Though the salary of the CIO does not come from any public funding, this salary is substantially higher than several UC campus chancellors, and even exceeds the salary of UC President Janet Napolitano whose base salary is $570,000. Bachher even receives a $9,000 car allowance and a $153,000 relocation stipend.

The UC is represented as a public institution of world-renowned prestige, but the new CIO’s salary makes clear that it more closely resembles a corporate conglomeration. The salary of the CIO is a seemingly unsurprising figure, and although the compensation is substantially less than private institutions, it still produces the message from the UC to the public that is loud and clear: profits over people.

Corporate salaries are typically reflective of employee compensation that is based upon gaining profit margins. These profit margins are represented through the continuous increase in tuition, pay cuts toward UC staff and workers, and the steady trend of hiring more faculty as part-time professors to dodge paying for retirement benefits and job security that tenured staff receive.

This steady trend of divesting from the staff, faculty, graduate students, families and undergraduates is affecting our collective mental and financial health in immeasurable ways — be it through the financial difficulty parents and students are having to pay for obtaining higher education, or the high burdens professors receive with seemingly finite resources to teach their classes, as well as the constant union-busting toward the staff and graduate students. All of these illustrations comprise a broader view of where the UC system stands on the value of educating, supporting and investing in UC staff, faculty and students for the future. This is our education at stake, and while we continuously hear from the UC that “public” entity budget cuts must be made, the salary of the CIO is a slap in the face to everyone who has been gravely affected by the financial cuts.

Currently student loan debt in the United States surpasses $1 trillion, and is the leading cause of debt within the U.S., second to only mortgage debt. The salary of the UC’s CIO in this tumultuous climate of economic disparity is disconcerting. Where do the leaders, the regents and the UC president see the most returns within their portfolio with the UC system in the future?

If the UC system was a “true” public institution, its chief investment would lie within the students. To assume that if the CIO is able to invest the $80 billion in funds and see high returns, and that these excess earnings would in turn be invested right back to the students is a naive and hopeful assumption. Maybe some returns would trickle down to better help the staff, faculty and students on the various financial strains they face, but how much would we really see at the end of the day?

Where is the UC system really standing when it comes to investing in the future for all of us? The answer is surely not in the students.